NR: 22-05

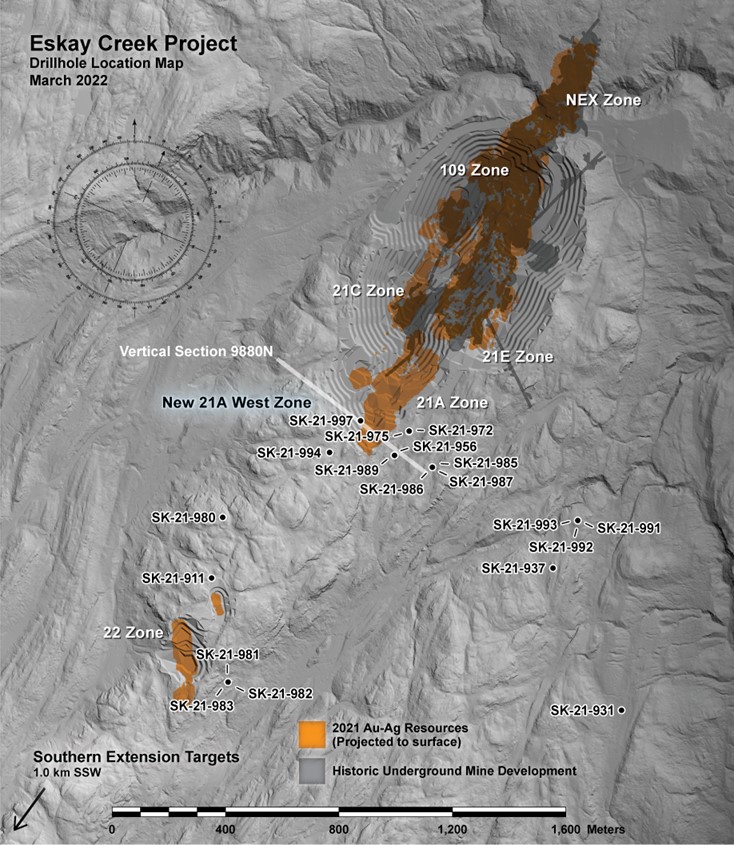

Vancouver, BC (March 9, 2022) Skeena Resources Limited (TSX: SKE, NYSE: SKE) (“Skeena” or the “Company”) is pleased to announce final drilling results from the 2021 regional and near mine exploration programs at the Eskay Creek gold-silver Project (“Eskay Creek” or the “Project”) in the Golden Triangle of British Columbia. Analytical results from the recently completed drill holes are detailed in this release. Reference images are presented at the end of this release as well as on the Company’s website.

New 2021 Exploration Program Highlights:

• 1.29 g/t Au, 36 g/t Ag (1.76 g/t AuEq) over 14.50 m (SK-21-972)

• 0.79 g/t Au, 26 g/t Ag (1.14 g/t AuEq) over 21.11 m (SK-21-972)

• 1.77 g/t Au, 200 g/t Ag (4.44 g/t AuEq) over 11.73 m (SK-21-983)

• 0.78 g/t Au, 120 g/t Ag (2.39 g/t AuEq) over 11.50 m (SK-21-985)

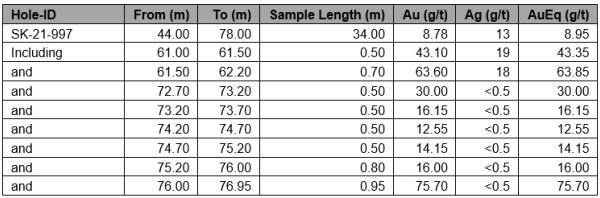

• 8.78 g/t Au, 13 g/t Ag (8.95 g/t AuEq) over 34.00 m (SK-21-997)

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. True widths and zone geometries cannot be definitively determined at this time. Grade-capping of individual assays has not been applied to the Au and Ag assays informing the length-weighted AuEq composites. Metallurgical processing recoveries have not been applied to the AuEq calculation and are taken at 100%. Samples below detection limit were nulled to a value of zero.

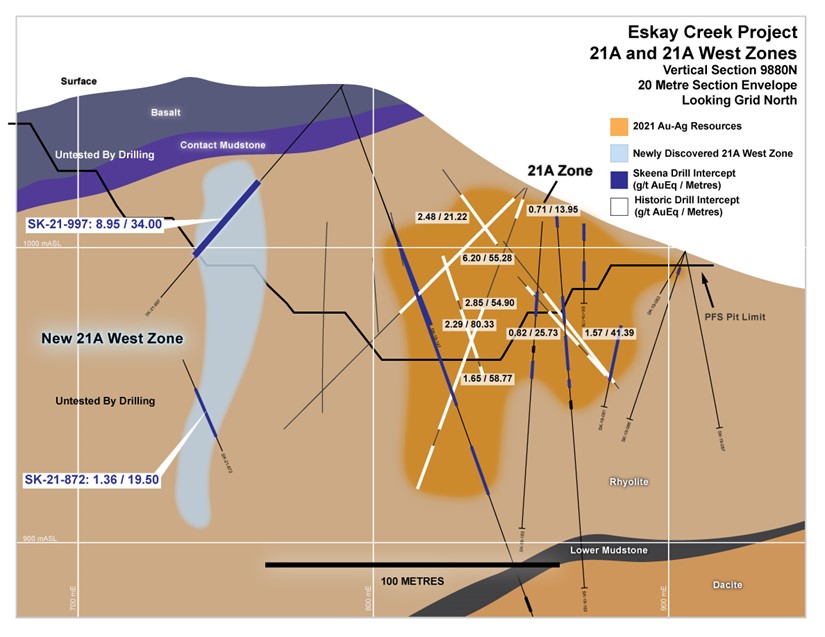

New In-Pit Discovery Expands 21A Zone

Following up on resource category conversion drilling performed in early 2021, exploratory drill hole SK-21-997 intersected high-grade gold mineralization averaging 8.78 g/t Au, 13 g/t Ag (8.95 g/t AuEq) over 34.00 m located 60 m west of Skeena’s current 21A Zone pit-constrained resources. Hosted entirely within the rhyolite sequence, this new mineralization is only 30 m vertically below surface. This discovery remains open for expansion 120 m to the north and already occurs within the limits of the contemplated open-pit from Skeena’s 2021 Prefeasibility Study (“PFS”). The high-grade gold and essentially negligible silver concentrations in this new intersection is uncharacteristic of rhyolite hosted mineralization at Eskay Creek. Refer to Table 1 below.

Table 1: Drill hole SK-21-997 length weighted drill hole composite and high-grade subintervals – 21A West Expansion

“Due to a lack of drilling, this new discovery which expands the 21A Zone to the west, was considered waste rock in the currently proposed PFS reserve pit area,” notes Paul Geddes P.Geo., the Company’s Vice President of Exploration and Resource Development. “We will work to expand and infill drill the 21A West Zone and potentially bolster the pit-constrained resources surrounding this newly discovered mineralization”.

Other Near Mine Targets

Additional mineralization has been discovered between the 21A and 23 Zones highlighted by drill hole SK-21-972, which intersected three intervals averaging 1.29 g/t Au, 36 g/t Ag (1.76 g/t AuEq) over 14.50 m, 0.79 g/t Au, 26 g/t Ag (1.14 g/t AuEq) over 21.11 m and 1.14 g/t Au, 23 g/t Ag (1.45 g/t AuEq) over 13.50 m. These intervals are hosted within the footwall dacite series as is the case with the recently discovered 23 Zone.

2022 Exploration Outlook

The Company is anticipating a staged drilling startup beginning in early Q2 2022, focusing on near mine and regional targets that were not explored during the 2021 drilling program. Overall, 60,000 m has been allocated to the 2022 exploration program which will continue to focus on supplementing the existing mine plan with additional near surface mineralization amenable to open-pit mining methods and will be paralleled by exploratory drill testing of the deep Mudstone extensions north of the former Eskay Creek mine. Allocation of meterage will remain results driven. Expansion and delineation drilling will also occur in the new 21A West Zone as well as the recently discovered 23 Zone.

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Prefeasibility Study for Eskay Creek in July 2021 which highlights an open-pit average grade of 4.57 g/t AuEq, an after-tax NPV5% of C$1.4B, 56% IRR, and a 1.4-year payback at US$1,550/oz Au. Skeena is currently completing both infill and exploration drilling to advance Eskay Creek to a full Feasibility Study in 2022.

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

Qualified Persons

Exploration activities at the Eskay Creek Project are administered on site by the Company’s Exploration Managers, Raegan Markel, P.Geo., John Tyler and Director of Exploration, Adrian Newton P.Geo. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Quality Assurance – Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently securely stored on site. Numbered security tags are applied to lab shipments for chain of custody requirements. The Company inserts quality control (QC) samples at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd., and is overseen by the Company’s Qualified Person, Paul Geddes, P.Geo, Vice President Exploration and Resource Development.

Drill core samples are submitted to ALS Geochemistry’s analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed and 1 kg is pulverized. Analysis for gold is by 50 g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 50 g fire assay fusion with gravimetric finish. Analysis for silver is by 50 g fire assay fusion with gravimetric finish with a lower limit of 5ppm and upper limit of 10,000 ppm. Samples with silver assays greater than 10,000 ppm are re-analyzed using a gravimetric silver concentrate method. A selected number of samples are also analyzed using a 48 multi-element geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS) and also for mercury using an aqua regia digest with Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) finish. Samples with sulfur reporting greater than 10% from the multi-element analysis are re-analyzed for total sulfur by Leco furnace and infrared spectroscopy.

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this press release constitute “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively, “forward-looking statements”). These statements relate to future events or our future performance. The use of words such as “anticipates”, “believes”, “proposes”, “contemplates”, “generates”, “targets”, “is projected”, “is planned”, “considers”, “estimates”, “expects”, “is expected”, “potential” and similar expressions, or statements that certain actions, events or results “may”, “might”, “will”, “could”, or “would” be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the results of the PFS, completion of a feasibility study, processing capacity of the mine, anticipated mine life, probable reserves, estimated project capital and operating costs, sustaining costs, results of test work and studies, planned environmental assessments, the future price of metals, metal concentrate, and future exploration and development. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company’s Management’s Discussion and Analysis (“MD&A”) for the year ended December 31, 2020, and the Company’s Annual Information Form (“AIF”) dated March 25, 2021. Such forward-looking statements represent the Company’s management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this press release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company’s 2020 MD&A and AIF, and in the Company’s other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR at www.sedar.com or on EDGAR at www.sec.gov.

Readers should not place undue reliance on such forward-looking statements. The Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Cautionary note to U.S. Investors concerning estimates of mineral reserves and mineral resources

Skeena’s mineral reserves and mineral resources included or incorporated by reference herein have been estimated in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by Canadian securities regulatory authorities, which differ from the requirements of U.S. securities laws. The terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “CIM Definition Standards – For Mineral Resources and Mineral Reserves” adopted by the CIM Council (as amended, the “CIM Definition Standards”). The U.S. Securities and Exchange Commission (the “SEC”) has mineral property disclosure rules in Regulation S-K Subpart 1300 applicable to issuers with a class of securities registered under the Securities Exchange Act of 1934 (the “Exchange Act”), which rules were updated effective February 25, 2019 (the “SEC Mineral Property Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. Skeena is not required to provide disclosure on its mineral properties under the SEC Mineral Property Rules or their predecessor rules under SEC Industry Guide 7 because it is a “foreign private issuer” under the Exchange Act and entitled to file reports with the SEC under MJDS.

The SEC Mineral Property Rules include terms describing mineral reserves and mineral resources that are substantially similar, but not always identical, to the corresponding terms under the CIM Definition Standards. The SEC Mineral Property Rules allow estimates of “measured”, “indicated” and “inferred” mineral resources. The SEC Mineral Property Rules’ definitions of “proven mineral reserve” and “probable mineral reserve” are substantially similar to the corresponding CIM Definition Standards. Investors are cautioned that, while these terms are substantially similar to definitions in the CIM Definition Standards, differences exist between the definitions under the SEC Mineral Property Rules and the corresponding definitions in the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Skeena may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Skeena prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Mineral Property Rules.

In addition, investors are cautioned not to assume that any part or all of Skeena’s mineral resources constitute or will be converted into reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any “measured”, “indicated”, or “inferred” mineral resources that Skeena reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or prefeasibility studies, except in rare cases where permitted under NI 43-101.

For these reasons, the mineral reserve and mineral resource estimates and related information presented herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

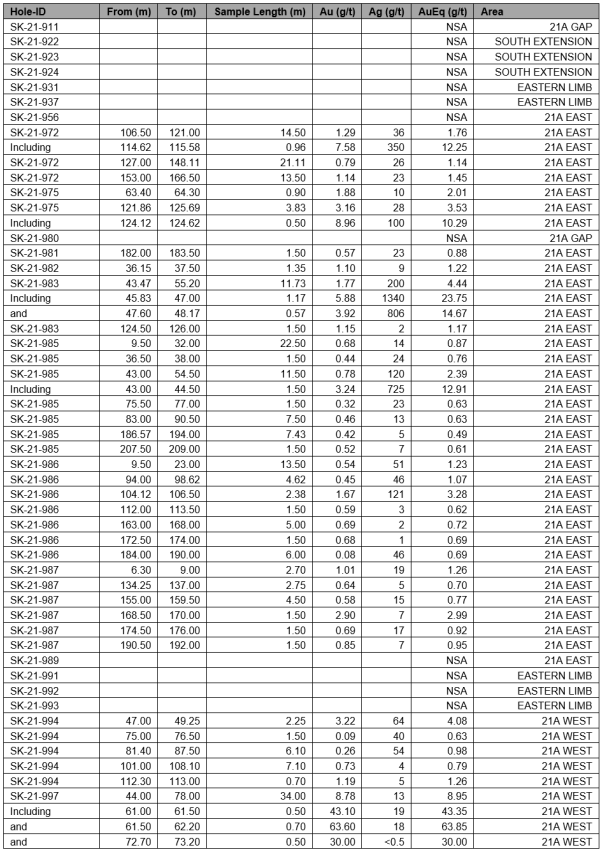

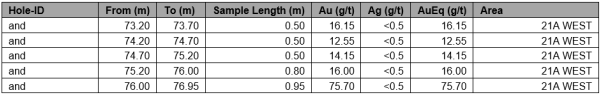

Table 2: Eskay Creek Project 2021 Exploratory Drilling Campaign Length-Weighted Drill Hole Composites:

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. True widths and zone geometries cannot be definitively determined at this time. Grade-capping of individual assays has not been applied to the Au and Ag assays informing the length-weighted AuEq composites. Metallurgical processing recoveries have not been applied to the AuEq calculation and are taken at 100%. Samples below detection limit were nulled to a value of zero. NSA – No Significant Assays.

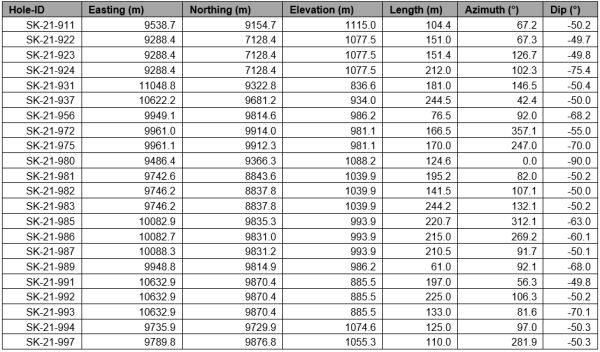

Table 3: Mine Grid Drill Hole Locations and Orientations: