NR:21-12

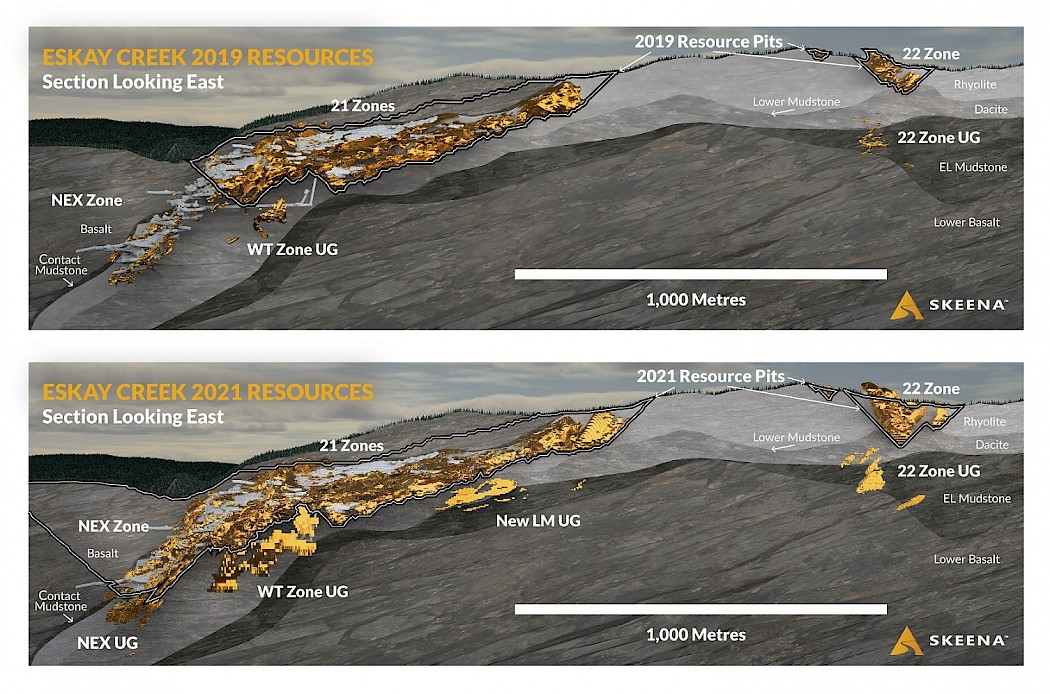

Vancouver, BC (April 7, 2021) Skeena Resources Limited (TSX: SKE, OTCQX: SKREF) (“Skeena” or the “Company”) is pleased to announce an updated Mineral Resource Estimate (“MRE"), for the Eskay Creek gold-silver project (“Eskay Creek”), located in the Golden Triangle of British Columbia, which has been reviewed and validated by SRK Consulting (Canada) Inc (“SRK”). The 2021 MRE was derived from 7,583 historical surface and underground diamond drill holes totalling 651,332 metres, with an additional 751 surface diamond drill holes completed by Skeena between 2018-2021 totalling 104,740 metres. The effective date of this MRE is April 7, 2021 and an updated technical report will be filed on the Company’s website and SEDAR within 45 calendar days of this disclosure. Reference images are presented at the end of this release as well as on the Company’s website.

2021 Eskay Creek Resources

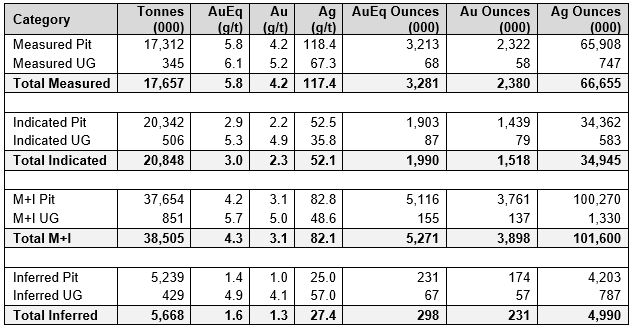

Table 1: Eskay Creek pit constrained resources reported at a 0.7 g/t AuEq cut-off grade and underground resources reported at 2.4 and 2.8 g/t AuEq cut-off grades for long-hole and drift and fill mining, respectively (UG = Underground).

Pit Constrained Resource Growth Discussion

The Company’s Phase 1 and Phase 2 infill drilling programs were immensely successful in not only recategorizing pit constrained resources but also adding additional resources in the 22 Zone, 21A Zone, 21B Zone and the recently discovered 21C-HW Zone. Furthermore, the NEX (Northern Extension) Zone has now been incorporated into the pit constrained resource base. This new Northern Pit Expansion integrates the largely Measured and Indicated NEX Zone and provides the potential for additional reserves.

In 2019, the Company’s MRE utilized conservative ‘zero-grade’ 1.0 metre buffers surrounding historical stopes and development partially imposed due to spatial uncertainty. Consequently, mineralization occurring inside these buffers was not reported. During 2021, numerous Phase 2 drill holes predictably intersected the modelled historical workings which provided spatial confidence resulting in the reduction of the buffers from 1.0 metres to 0.2 metres. Overall, this translated into the reporting of an additional 731k tonnes averaging 25.4 g/t AuEq (597koz AuEq).

Table 2: Measured, Indicated and Inferred pit constrained resources reported at a 0.7 g/t AuEq cut-off grade.

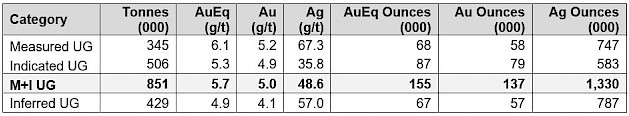

Underground Constrained Resources Discussion

Determination of underground resources with reasonable prospects for economic extraction was completed with stope optimization software that considered both long-hole and drift and fill mining methods based on the geometries of zones. Underground resources in the NEX Zone and 22 Zone were only informed by historical drilling data, however, the Company’s drilling programs have facilitated growth in the Water Tower Zone (WTZ) and Lower Mudstone (LM).

Table 3: Measured, Indicated and Inferred underground constrained resources reported at a 2.4 g/t AuEq cut-off grade for long-hole mining and 2.8 g/t AuEq cut-off grade for drift and fill mining.

Walter Coles, Skeena’s President & CEO commented, “I would like to congratulate Skeena’s Vice President Exploration & Resource Development, Paul Geddes, P.Geo and Kathi Dilworth and their teams. They have delivered a terrific new resource estimate for Eskay Creek. The Measured and Indicated resources have increased by an astounding 186%, on a tonnage weighted basis, since our last resource report. I am eager to see how much more Paul and Adrian Newton, the Company’s Director of Exploration, can continue to grow the size of Eskay Creek as we target a Tier 1 annual production and reserve profile.”

Measured and Indicated Resources

The conversion of pit constrained resources to the Measured and Indicated categories is an important de-risking milestone for Eskay Creek. The abundance of resources now categorized as Measured are especially significant due to the very high confidence level of this category. The Company anticipates a substantial percentage will ultimately convert to Proven Reserves once Feasibility level studies are completed. On a tonnage weighted basis, 40%, 48% and 12% of the current pit constrained resources are respectively categorized as Measured, Indicated and Inferred.

Additional 2021 NEX Studies

Based on tonnage, 12% of the new pit constrained resources are categorized as Inferred resources. The Company is finalizing a small surface-based drilling program to convert these small pods of scattered mineralization to the Measured and Indicated categories. In the area of the Northern Pit Expansion, a program of geotechnical drilling and metallurgical sample collection will occur in Q2 2021 to enable the upgrade of resources to reserves.

Resource Breakdown by Lithology

Unmined mineralization at Eskay Creek is hosted largely in the Rhyolite facies, which has lower concentrations of the epithermal suite of elements (Hg-As-Sb) relative to the Contact Mudstones. Preferential historical development and mining of the extremely high-grade mineralization hosted in the Contact Mudstone has resulted in extensive depletion of resources in this rock type. The 2021 pit constrained MRE indicates that on a tonnage weighted basis, 68% of the resources are hosted within the Rhyolite facies with only 18% hosted in the remaining unmined Contact Mudstone. The outstanding 14% occurs predominantly within the hanging wall andesite-sedimentary lithology package which lies stratigraphically above the Contact Mudstone, with a minor amount in the footwall Dacite.

Accelerated 2021 Exploration Program Initiated

With the infill drilling programs completed and the pit constrained resources having been largely converted to the Measured and Indicated categories, the Company has initiated a property scale exploration program. This accelerated program is designed to define additional near surface, bulk tonnage mineralization with the goal of expanding the current resource base and to supplement the existing mine plan. The program will involve a data compilation and interpretation period followed by judicious target ranking that will culminate in drill testing of near mine and regional targets in H2 2021. Dr. Harold Gibson, one of the world’s foremost experts in VMS systems, has been engaged by the Company to assist the program which will be spearheaded by the Company’s Director of Exploration, Adrian Newton, P.Geo.

Eskay Creek Deposit Mineral Resource Estimate Notes

The mineral resources disclosed in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) standards on mineral resources and reserves definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council.

• Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves.

• As defined by NI 43‑101, the Independent and Qualified Person for the Eskay Creek MRE is Ms. S. Ulansky P.Geo., of SRK Consulting (Canada) Inc. who has reviewed and validated the Eskay Creek MRE. The effective date of the MRE is April 7, 2021.

• Resources are reported in-situ and undiluted for the pit constrained and underground scenarios; both are considered to have reasonable prospects for economic extraction.

• In accordance with NI 43-101 recommendations, the number of metric tonnes was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

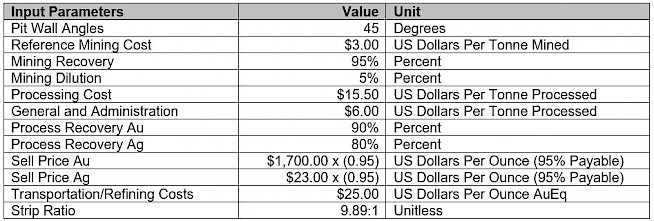

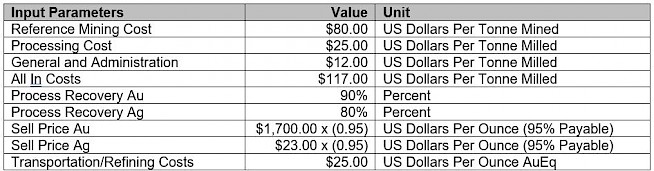

• Metal prices used for the AuEq calculation are US$1,700 per ounce of gold, and US$23.00 per ounce of silver. AuEq = Au (g/t) + [Ag (g/t)/74].

• Metallurgical recoveries reflective of test work that averages 90% Au and 80% Ag were utilized in the determination of cut-off grades for the open pit and underground resources.

• The calculated pit constrained cut-off grade was determined to be 0.66 g/t AuEq, whereas the long-hole stoping and drift and fill underground mining method cut-off grades were calculated to be 2.4 g/t AuEq and 2.8 g/t AuEq, respectively. A pit constrained cut-off of 0.7 g/t AuEQ was selected for the MRE. Cut-off grades must be re-evaluated considering prevailing market conditions (including gold prices, exchange rates and costs).

• Two models were constructed in a two-stage process: a stage one pit constrained model using a 9 x 9 x 4 metre block size using 2 metre capped composites. An underground model using a 3 x 3 x 2 metre block size using 1 metre capped composites was estimated in stage two.

• Block tonnage was estimated from volumes using bulk density values projected from defining rock type groups. Specific gravity values coded into the block model range from 2.66 g/cm3 to 3.0 g/cm3.

• The geological model was updated in 2021 to include hanging wall and footwall sediments, which were previously merged within the stratigraphic packages. In addition, extrusive units were delineated below the prolific rhyolite lithology package.

• Eighty-four (84), mineralization domains were created in Leapfrog GeoTM (Seequent) using two distinct methods: (1) an Indicator RBF Interpolant utilizing a nominal cut-off grade of 0.5 g/t AuEq and probability of 50% was used for the Contact Mudstone unit, and (2) the Interval Selection tool using a 0.5 g/t AuEq cut-off was the method of choice for the mineralization domains in the remaining lithology types. The mineralization domains were separated into major fault block and historical mining zones, and each domain was modified or reassessed individually to consider presiding mineralization features.

• All eighty-four (84), mineralization domains were estimated and those blocks that were captured within the optimized pit shell at a 0.7 g/t AuEq cut-off were reported as pit constrained resources. Nineteen of those mineralization domains, which fell below the level of the optimized pit, were reported within underground stope optimized shapes.

• Five low grade shells were constructed and estimated along with the 84 mineralization domains slated for the pit constrained resources only.

• A 3.0 metre hard boundary around all underground stopes was constructed so that high grade composites from within mined out areas had limited influence. The 3.0 metre restricting boundary was utilized in both the pit constrained and underground estimation models.

• Grade capping was performed on each lithology-separated domain using 2 metre composites in the open pit model and 1.0 metre composites in the underground model, with both composite files honouring mineralized domain boundaries. Composites were distributed equally in length.

• Within the 84 mineralization domains gold capping values ranged from 7 to 650 g/t and silver capping values ranged from 40 to 25,000 g/t in the 2.0 metre composite file. Grade capping was performed separately in the 5 low grade zones and did not exceed 9 g/t gold and 200 g/t silver. Gold capping values ranged from 4 to 400 g/t and silver capping values ranged from 10 to 30,000 in the 1.0 metre composite file.

• Gold and silver variograms were used to determine the spatial relationship of composites over distance. Two metre composites established the primary orientation, nugget, sills and ranges per rock type-divided domain for the open pit model. For the underground estimate, variograms for the 1.0 metre composites used the same orientations as the 2.0 metre composites, however the nugget, sills and ranges were accordingly updated.

• Ordinary Kriging was used for the estimation of gold and silver in all domains. Resources were estimated using Maptek VulcanTM (version 2021.0.1) using sub-blocking capabilities of 3 x 3 x 2 metre cell sizes for the pit constrained model, and 1 x 1 x 1 metre cell sizes for the underground model.

• Search orientations were modified with Dynamic Anisotropy using a surface which mimicked the local lithological units. Dynamic Anisotropy was used for the 21A, 21B, 21C and the Lower Mudstone Zone. The remaining zones used an orientation defined by the variogram.

• The mineral resources were estimated using three passes with increasing search radii based on variogram ranges. Pass 1 approximated 2/3 of the range of the variogram; Pass 2 equalled the range of the variogram and Pass 3 equalled 2.5 X the variogram range in the pit constrained and underground model.

• In both models, Pass 1 used a minimum of 8 composites and a maximum of 10 composites. Pass 2 used a minimum of 5 composites and a maximum of 15 composites and Pass 3 used a minimum of 3 composites and a maximum of 15 composites. A maximum of 2 composites per hole were specified.

• Hard boundary interpolations were honoured between lithologies within the domains.

• A low grade envelope model was estimated using 2 metre capped composites within five domains. The variogram orientation for these low-grade domains were inherited from the nearest mineralization domain. One estimation pass using a restricted search of 25 m x 25 m x 15 m was allocated using a minimum of 3 composites and a maximum of 10 composites per estimated block. A maximum of 2 composites per hole were specified. Only coherent waste zone blocks estimated using a minimum of three drill holes were included into the Inferred category.

• Measured, Indicated and Inferred resources were classified according to the following scheme for the pit constrained model:

o The Measured category is defined as blocks interpolated only within Pass 1, using a minimum of 4 drill holes, a kriging variance of less than 0.3 and an average distance of less than 15 metres to the gold composites.

o The Indicated category is defined by blocks interpolated within Pass 1 and Pass 2 only, and using a minimum of 4 drill holes.

o The Inferred category is defined by blocks interpolated within Pass 1, 2 and 3 using a minimum of 2 holes and a kriging variance of less than 0.8.

• For the underground model, the resources were classified according to the following scheme:

o The Measured category is defined as blocks interpolated within Pass 1 only using a minimum of 4 holes and an average distance of less than 15 meters to the gold composites.

o The Indicated category is defined by block interpolated during Pass 1 and 2 using a minimum of three drill holes.

o The Inferred category is defined by block interpolated within Pass 1, 2 and 3 using a minimum of 2 holes.

• In consultation with SRK’s geotechnical team who reviewed the documentation on fill-type used previously at the Eskay Creek Mine, an exclusion buffer of 1.0 metre surrounding the underground workings for the underground model was specified, whereas a buffer of 0.2 metres surrounds the underground workings in the proposed pit constrained model. Estimated mineralization that occurs within these buffers is not included in this MRE.

• Estimates use metric units (metres, tonnes and g/t). Metal contents are presented in troy ounces (metric tonne x grade / 31.10348).

• Neither the Company, nor SRK, is aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect this mineral resource estimate.

• The abundance and significance of As, Hg and Sb is currently under evaluation.

• The quantity and grade of reported Inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to re-define the Inferred mineral resources as Indicated mineral resources. It is uncertain if further exploration will result in upgrading them to the Indicated mineral resources category.

Table 4: Pit constrained scenario assumptions for determining cut-off grades with reasonable prospects of economic extraction.

Table 5: Underground scenario assumptions for determining cut-off grades with reasonable prospects of economic extraction.

Eskay Creek Mineralization

The Eskay Creek deposit represents a shallow water, bimodal volcanic sequence hosted in a fault bounded basin with an epithermal VMS signature. Rhyolite facies volcanics are overlain by mafic volcanics with a clastic mudstone occurring at the contact between the two volcanic episodes. This mudstone represents the period of quiescence between the two volcanic events and is spatially and temporally related to the main mineralizing event at Eskay Creek. The epithermal suite of elements (Hg-Sb-As) and bonanza precious metal grades dominantly occur at this interface but are not homogenously distributed throughout the mudstone. Rather, they are spatially associated with vents fed from underlying synvolcanic feeders.

Due to the higher precious metal tenor of the mudstone-hosted mineralization, the vast majority of historical production at Eskay Creek occurred within this rock type whilst the Rhyolite-hosted feeder style mineralization was less developed due to its lower Au-Ag tenor. Rhyolite-hosted mineralization is not enriched in Hg-Sb-As and was often blended with mudstone-hosted zones to reduce smelter penalties for the on-site milled concentrates and Direct Shipped Ore (DSO).

About Skeena

Skeena Resources Limited is a Canadian mining exploration company focused on revitalizing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a robust Preliminary Economic Assessment in late 2019 and is currently focused on infill and exploration drilling to advance Eskay Creek to full Feasibility by the end of 2021. Additionally, Skeena continues exploration programs at the past-producing Snip gold mine.

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

Qualified Persons

The Independent and Qualified Person for the Eskay Creek MRE is Ms. Sheila Ulansky P.Geo., of SRK Consulting (Canada) Inc. (Vancouver), who has reviewed, validated and approved the Eskay Creek MRE as well as the technical disclosure in this release. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Mr. Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting its activities on its various exploration projects.

Cautionary note regarding forward-looking statements

Certain statements made and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations. Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “could” or “would”. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.