Vancouver, BC (November 07, 2019) Skeena Resources Limited (TSX.V: SKE, OTCQX: SKREF) (“Skeena” or the “Company”) is pleased to announce the initial Preliminary Economic Assessment (“PEA”) completed by Ausenco Engineering Canada Inc. (“Ausenco”), supported by SRK Consulting (Canada), and AGP Mining Consultants, for the Eskay Creek gold-silver project (“Eskay Creek” or the “Project”) located in the Golden Triangle of British Columbia.

Eskay Creek 2019 PEA Highlights:

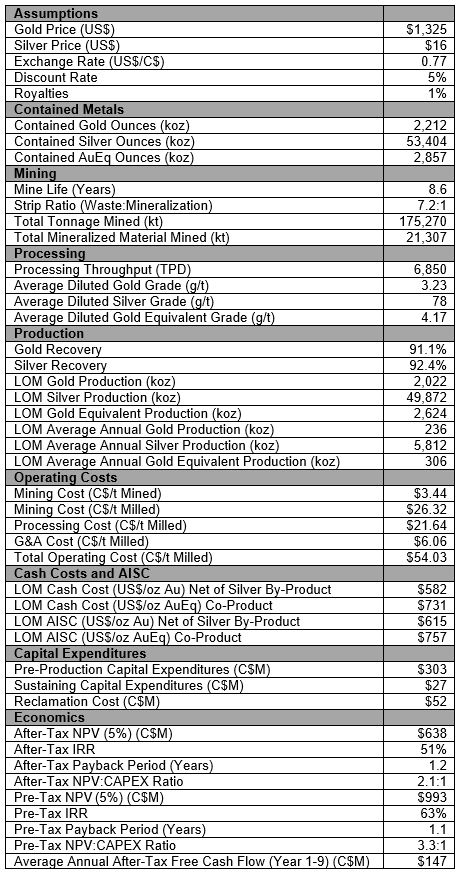

- High-grade open-pit averaging 3.23 g/t Au, 78 g/t Ag (4.17 g/t AuEq) (diluted)

- After-tax NPV5% of C$638M (US$491M) and 51% IRR at US$1,325/oz Au and US$16/oz Ag

- After-tax payback period of 1.2 years

- Pre-production capital expenditures (CAPEX) of C$303M (US$233M)

- After-tax NPV:CAPEX Ratio of 2.1:1

- Life of mine (“LOM”) average annual production of 236,000 oz Au, 5,812,000 oz Ag (306,000 oz AuEq)

- LOM all-in sustaining costs (AISC) of C$983/oz (US$757/oz) AuEq recovered

- LOM cash costs of C$949/oz (US$731/oz) AuEq recovered

- 6,850 tonne per day (TPD) mill and flotation plant producing saleable concentrate

Skeena’s CEO, Walter Coles commented, “Eskay Creek was a remarkable discovery that became an extraordinary underground mine in 1994 and produced until 2008. This PEA demonstrates that Eskay Creek still has a bright future ahead, revitalized as an open-pit gold and silver mine, with the additional possibility for underground mining. The Project has the potential to produce an average of 306,000 gold-equivalent ounces per year with a diluted mill feed grade of 4.17 grams per tonne gold-equivalent. Also, as a brownfield site, Eskay Creek benefits from tremendous infrastructure installed by the previous operators. Finally, by creating a gold concentrate rather than doré, we are able to keep initial capital costs very low, at US$233 million, relative to the amount of precious metals produced; this also simplifies and reduces technical risks for the Project.”

PEA Overview

The 2019 Eskay Creek PEA considers an open-pit mine with on-site treatment of the mined material by conventional milling and flotation to recover a gold-silver concentrate for provision to third-party smelters. The mine will be an owner-operated, standard truck and shovel open-pit, with a leased mining fleet. At present, no contributions from previously reported underground resources are incorporated into this study. The processing capacity of 6,850 tonnes per day will result in a production lifespan of 8.6 years. An additional 1.5 years of pre-stripping, stockpiling and mine access development is planned prior to the processing facility becoming fully operational in Year 1. The PEA leverages Eskay Creek’s extensive existing infrastructure, including all-weather access roads, previously permitted tailing storage facilities (TSF) and proximity to the recently commissioned 195 MW hydroelectric facilities and linked power grid.

The PEA is derived from the Company’s pit-constrained resource estimate (February 28, 2019), and does not include results from the recently initiated and ongoing 2019 Phase I infill drilling program. The effective date of the PEA is November 7, 2019 and a technical report will be filed on the Company’s website and SEDAR within 45 days of this disclosure.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. The PEA is preliminary in nature and includes inferred mineral resources that are too speculative to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that PEA results will be realized.

Table 1: 2019 Eskay Creek 2019 PEA Detailed Parameters and Outputs

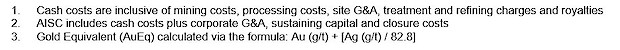

Sensitivities

After-tax economic sensitivities to commodity prices are presented in Table 2 illustrating the effects of varying gold and silver prices as compared to the base-case. Additional Project sensitivities will be presented in the Technical Report.

Table 2: After-Tax NPV (5%) and IRR Sensitivities to Commodity Prices

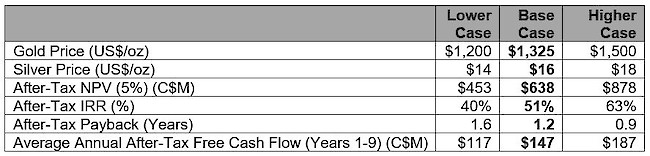

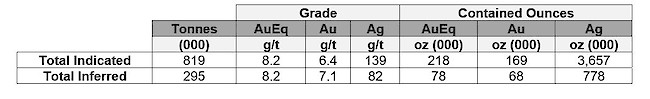

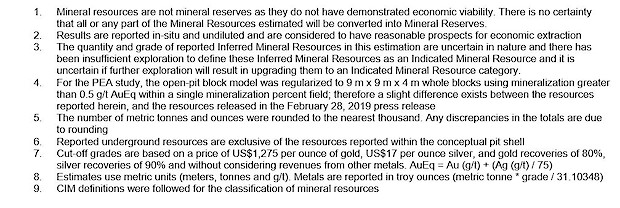

Eskay Creek Mineral Resource Estimate

The Company’s current Mineral Resource Estimate (MRE; effective date of February 28, 2019) completed by SRK Consulting (Canada) forms the basis for this PEA. The MRE does not include drilling results from the Company’s recently initiated and ongoing 2019 Phase I infill program.

Table 3: Pit constrained Mineral Resource Statement reported at 0.7 g/t AuEq cut-off:

Table 4: Underground Mineral Resource Statement reported at a 5.0 g/t AuEq cut-off:

Mining Overview

An open-pit mining scenario is the basis for this PEA; underground precious metal resource contributions are not being considered at this time. The owner-operated, leased mining fleet will utilize conventional truck and shovel methods with 22m3 shovels and 142 tonne haul trucks. Support equipment is comprised of track dozers, graders and hydraulic excavators; additional support equipment to maintain production during seasonal periods of high snowfall has also been incorporated.

The mine designs and scheduling were engineered to provide 2.5 Mt per year of mineralization to the 6,850 TPD process plant. A total of 21.3 Mt of diluted mill feed averaging 3.23 g/t gold and 78 g/t silver (4.17 g/t AuEq), is expected to be processed over the life of mine from the main pit area and a smaller satellite pit hosting the 22 Zone. Mill feed will be trucked to a primary crusher located to the west of the main pit and then conveyed overland two kilometers to the process facility. Waste totaling 154.0 Mt will be stored in a dump adjacent to the main and satellite open pits with a portion backfilled into the pit as the mining sequence advances towards the north. Open-pit mining dilution has been factored at 15%.

Conservative pit slopes were applied to the mine design with recognition of areas that exhibit lower rock quality. Default Inter Ramp Angles (IRA) are 42 degrees throughout the hanging wall andesites and footwall rhyolites, with 32-degree IRA slope allowance in the less competent mudstones. Batter angles of 65 degrees have been applied throughout the entire design.

Metallurgical Optimizations

The former Eskay Creek mine operated over 14 years from 1994 and produced approximately 3.3 million ounces of gold and 160 million ounces of silver, either in flotation concentrate, with average grades of 45 g/t Au and 2,224 g/t Ag, or as Direct Shipped Ore (DSO).

To support this PEA, metallurgical test work was conducted by Blue Coast Research using recently drilled samples from the 21A, 21B and 22 zones, which represent a significant proportion of the open-pit mine plan. Test work included comminution, whole-ore leaching, with gravity recovery as well as flotation of a bulk sulphide concentrate. Low recovery cyanide leach extractions were observed in the testwork, attributable to the free gold occurring as fine particles associated with sulphide minerals. In addition, in this test work gravity concentration did not increase the overall gold recovery.

The 2019 metallurgical program has focused on optimizing bulk sulphide flotation, resulting in higher recoveries and lower mass pull than was historically realized at Eskay Creek during its previous operation. Flotation tests were performed on samples over a range of gold and silver head grades to generate recovery relationships which were used to estimate the annual concentrate production over the mine life. The results indicate that at an average head grade of 3.2 g/t gold and 78 g/t silver, recoveries of 91% for gold and 92% for silver were estimated, with production of a saleable concentrate containing 25 g/t Au, 604 g/t Ag, 620 ppm Hg, 0.71% As and 1.25% Sb.

Processing Overview

Run-of-mine (ROM) material is trucked from the mine and either stockpiled or direct tipped into the primary crusher. Primary crushed feed material is in turn conveyed overland two kilometers to the mill facility and stacked onto a covered coarse stockpile. The ROM material is considered relatively competent with a design competency measurement of 32 and bond rod and ball mill work indices of 21.0 kWh/t and 19.4 kWh/t, respectively. To provide the target particle size of P80 75 µm the comminution circuit comprises a 3.3 MW semi semi-autogenous grinding (SAG) mill, 7.9 m diameter by 3.7 m effective grinding length, and a 6.0 MW ball mill, 6.1 m diameter by 8.8 m length. A pebble crushing circuit is also included. Ground material is processed through a conventional flotation circuit including rougher/scavenger tank cells. Rougher-scavenger concentrate is subsequently ground to a target size of P80 20 µm prior to multiple stages of cleaning to produce a gold-silver concentrate. Ultimately, flotation tailings are pumped to the existing Tailings Storage Facility (TSF), for disposal. Flotation concentrate is thickened and filtered, and trucked to the port at Stewart, BC for loading onto ships and transportation to third-party smelters worldwide.

Concentrate Marketing Studies

Multiple marketing assessments have been completed to support this PEA which confirm that Eskay Creek concentrate, at a target grade of 25 g/t Au, is readily saleable. The preferred preliminary contract terms for the concentrate have been provided by Chinese smelters, however multiple offtakes are available. Smelters onshore and within Europe have also been identified as potential markets, however they may apply higher penalties for non-payable elements. The Company has been offered a term sheet for the entire concentrate production, which has been used as the basis for the financial model, and includes gold and silver payabilities, industry standard treatment and refining charges, and penalties for impurities; antimony is not considered to be a payable element at this time.

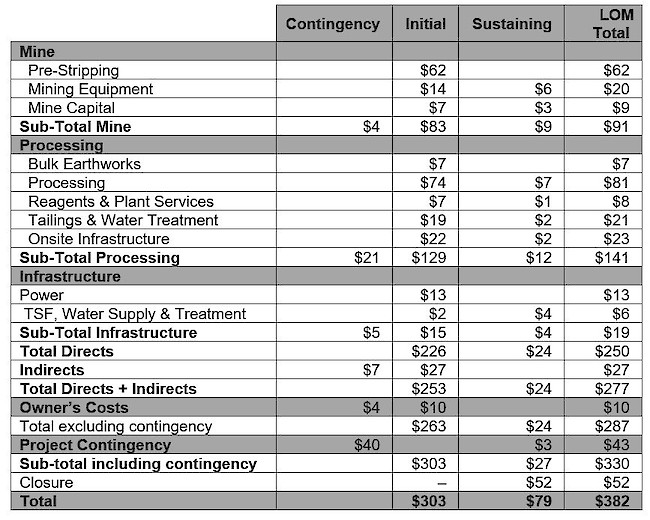

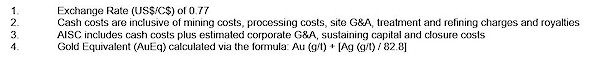

Capital Costs

Table 5: Project Capital Cost Estimates (C$M) (totals may differ due to rounding):

Environmental and Permitting Considerations

Eskay Creek represents a closed mine with existing permits for mine discharge and waste disposal. The site has been maintained in good standing and environmental monitoring has been ongoing during operations and since the site was closed in 2008. There is a substantial database of environmental information for the site and region spanning almost 30 years. To accommodate the mine design contemplated by the PEA, updated environmental assessment and mine permits will be required. The Company is currently performing a gap analysis of existing environmental data to identify additional data needs with the intent of carrying out environmental baseline studies to advance the permitting process.

Community Relations

Eskay Creek has maintained a long-standing relationship with the Tahltan Nation. Previous operators maintained agreements with the Tahltan which included provisions for training, employment, and contracting opportunities. The Company has been working in the Tahltan Territory since 2016 and has developed a strong working relationship with the Nation. Skeena also maintains formal agreements with the Tahltan Central Government which guide communications, environmental practices, and contracting and employment opportunities for projects in Tahltan Territory. Skeena participates in the BC Regional Mining Alliance (BCRMA) which is a partnership between First Nations, the BC Government, AME BC and exploration companies operating in the Golden Triangle region of BC. The BCRMA provides a platform for all parties to collaborate in communications with potential investment partners on opportunities in the region.

Project Opportunities and Value Enhancements

The 2019 PEA clearly demonstrates that Eskay Creek has the potential to become an economically viable project. Additional opportunities and next steps include:

- Continued drill conversion of inferred resources to the measured and indicated categories

- Potential for expansion and upgrading of the existing pit constrained and inclusion of underground resources

- Mine scheduling investigations allowing for the further optimization of blending scenarios

- Supplementary metallurgical optimizations including deposit-wide variability testing

- Geotechnical investigations to complement and potentially enhance the current pit slope designs

- Gap analyses and environmental baseline studies to support expedited permitting

- Further optimization of water management infrastructure

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release.

Sheila Ulansky, P.Geo., Senior Resource Geologist for SRK Consulting (Canada) Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release.Ms. Ulansky is responsible for the 2019 Mineral Resource Estimate for the Eskay Creek Project.

Robin Kalanchey, P.Eng, Director, Minerals & Metals - Western Canada for Ausenco Engineering Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release.Mr. Kalanchey is responsible for processing, process and infrastructure capital and operating cost estimation, financial analysis and marketing.

Gordon Zurowski, P.Eng, Principal Mining Engineer for AGP Mining Consultants Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release.Mr. Zurowski is responsible for mine capital and operating cost estimation and supervision of the mine design.

Adrian Dance, P.Eng, Principal Consultant (Metallurgy)for SRK Consulting (Canada) Inc., is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release.Dr. Dance is responsible for mineral processing and metallurgical testing.

The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration and development activities on its projects.

About Skeena

Skeena Resources Limited is a junior Canadian mining exploration company focused on developing prospective precious and base metal properties in the Golden Triangle of northwest British Columbia, Canada. The Company’s primary activities are the exploration and development of the past-producing Snip and Eskay Creek mines. In addition, the Company has completed a Preliminary Economic Assessment on the GJ copper-gold porphyry project.

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Cautionary note regarding forward-looking statements

Certain statements made and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations.Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “could” or “would”.Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters.While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Suite 650, 1021 W. Hastings St. Vancouver, B.C., Canada V6E 0C3

Tel: (604) 684-8725 Fax: (604) 558-7695 Email: info@skeenaresources.com