NR: 23-20

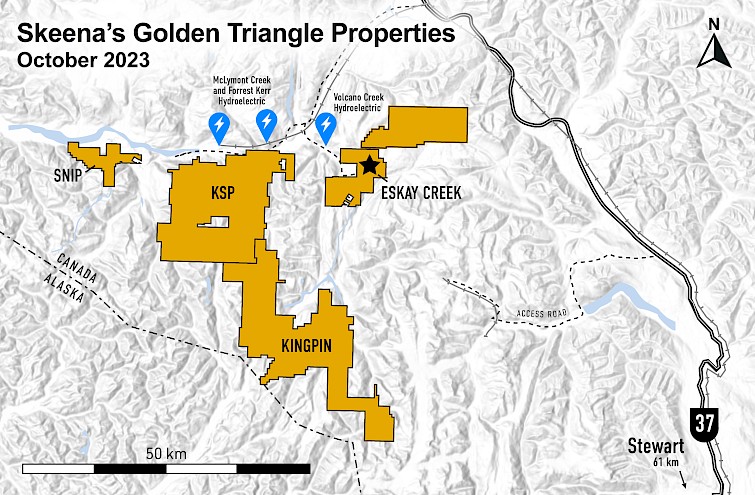

Vancouver, BC (October 5, 2023) Skeena Resources Limited (TSX: SKE, NYSE: SKE) (“Skeena” or the “Company”) is pleased to provide an update on the grassroots regional assessment of its 100% owned KSP Property (“KSP” or the “Property”), located 24 kilometers southwest of Eskay Creek in the Golden Triangle of British Columbia, Canada. KSP was acquired by Skeena on June 1, 2022 following the acquisition of QuestEx Gold & Copper Ltd. This acquisition added a total of 64,000 hectares of largely unexplored, highly prospective regions to the Company’s already significant land package.

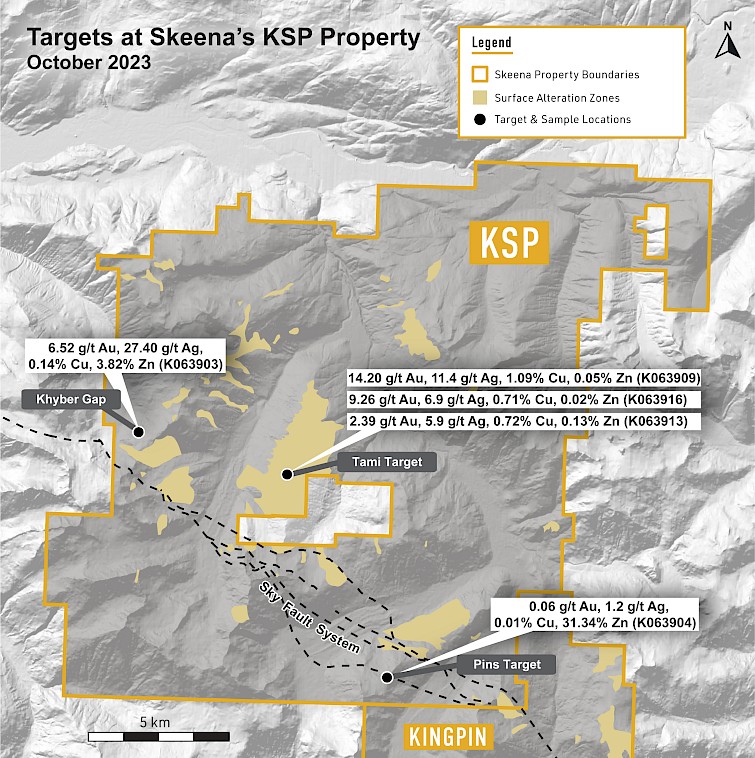

The first pass of exploration on the KSP Property this year was completing property-scale stream sediment sampling to identify geochemical anomalies. Based on the results of these efforts and historical data, the team completed geological mapping, sampling, and prospecting with the objective of identifying the source, style and scale of mineralization present. Select rock sample results from KSP that Skeena has received to date are detailed below.

2023 KSP Rock Grab Sample Highlights:

- Tami Target

- 14.20 g/t Au, 11.4 g/t Ag, 1.09% Cu, 0.05% Zn (K063909)

- 9.26 g/t Au, 6.9 g/t Ag, 0.71% Cu, 0.02% Zn (K063916)

- 2.39 g/t Au, 5.9 g/t Ag, 0.72% Cu, 0.13% Zn (K063913)

- Khyber Gap

- 6.52 g/t Au, 27.40 g/t Ag, 0.14% Cu, 3.82% Zn (K063903)

- Pins Target

- 0.06 g/t Au, 1.2 g/t Ag, 0.01% Cu, 31.34% Zn (K063904)

*Refer to the maps below for reference to location of samples

Paul Geddes, Skeena’s Senior Vice President of Exploration & Resource Development, commented “Despite the high prospectivity of KSP, the scarceness of historical exploration work is astonishing. By leveraging our team’s extensive proficiency and knowledge of the area, we plan to execute undivided and pragmatic exploration programs as the Company continues to explore our regional land package of over 100,000 hectares.”

The sections below provide a regional geological overview as well as detailed descriptions of the targets identified at KSP.

Gold-Copper Mineralization Confirmed at KSP Property

Field work this season at KSP has successfully identified a continuum of mineralization styles including deeper Au-Cu porphyry style mineralization, peripheral skarn and replacement styles of mineralization as well as high-level epithermal veins along a 17-kilometer long section of the prospective Bronson Corridor. The Tami, Pins and Khyber Gap targets highlighted on the map below are all located on the Bronson Corridor.

The Bronson Corridor is a 25-kilometer long mineralized belt of receptive Upper Triassic Stuhini Group volcanic and sedimentary units and Lower Jurassic Hazelton Group volcanic and volcano-sedimentary units intruded by Early Jurassic plutons, stocks, and dikes of the Lehto batholith. It extends southeast from Skeena’s past-producing Snip mine and is characterized by extensive quartz-sericite-pyrite alteration zones and precious and base metal-rich veins and stockworks spatially associated with the intrusive suite. The Bronson Corridor is bound to the southwest by the regional-scale Sky Fault System, a set of basin-bounding normal faults that were reactivated as post-mineral reverse faults and likely localized the emplacement of Early Jurassic intrusions and related Au-Cu porphyry mineralization.

Skeena considers KSP early stage given the historically fragmented ownership, former depressed commodity prices and lack of sufficient funding to systematically explore the district. Excluding the Inel prospect, only 12,514 metres of widely spaced, shallow historical drilling has been completed on the Property. With the Company’s focus this season being property-scale, early-stage data compilation that will assist in methodically evaluating the mineral potential and help define more focused targets moving forward, the technical team was very encouraged with the results and identification of three exciting targets: Tami, Khyber Gap, and Pins.

Tami Target

The Tami target is identifiable by a 6 x 2.5-kilometer package of strongly quartz-sericite-pyrite altered andesitic volcanic rocks that comprise an elongated northeast trending ridge in the central part of the Property. High tenor Au-Cu mineralization has been confirmed in rock grab samples from select areas within the andesitic cover rocks and also from propylitic to potassic altered intrusive dikes cut by multi generational porphyry style veins:

- 14.20 g/t Au, 11.4 g/t Ag, 1.09% Cu, 0.05% Zn (K063909)

- 9.26 g/t Au, 6.9 g/t Ag, 0.71% Cu, 0.02% Zn (K063916)

- 2.39 g/t Au, 5.9 g/t Ag, 0.72% Cu, 0.13% Zn (K063913)

Limited historical drilling of 6,261 metres over 40 holes focused on the near surface environment with the average hole length only measuring approximately 150 metres. The interpreted deeper intrusive body underlying the andesite cover rocks has yet to be drill tested.

New Khyber Gap Occurrence

In the northwest part of the KSP Property, receding glaciers have exposed new Au-Ag-Cu-Zn sediment hosted, replacement style mineralization at the Khyber Gap target. Grading 6.52 g/t Au, 27.40 g/t Ag, 0.14% Cu and 3.82% Zn, this new exposure is located near the Sky Fault in an area two kilometers south-southwest of the Inel prospect. Based on historical descriptions from Inel, mineralization at Khyber Gap appears to be similar in nature and suggests potential to expand this style of mineralization into new areas. There is no historical drilling recorded in this locale.

New Pins Target

Immediately adjacent to the Sky Fault System in the southeast corner of the Property, the Pins target is a 3 x 1.5-kilometer quartz-sericite-pyrite alteration zone. It is characterized by multi-phase intrusive units containing anomalous Au-Cu mineralization capped by andesitic volcanics in the footwall of the fault. Approximately 650 metres in elevation higher and within the hanging wall block of the fault, a new occurrence of Zn-rich epithermal veins up to 1.5 metres wide cutting andesitic volcanic units was discovered by field crews this season highlighted by a surface grab sample that graded 0.06 g/t Au, 1.2 g/t Ag, 0.01% Cu, 31.34% Zn. These veins potentially represent a high-level manifestation of a much deeper hydrothermal system, or possibly a porphyry center. Only one hole totaling 201 metres was completed at this target in 2018.

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the Eskay Creek and Snip Projects, two past-producing mines located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Feasibility Study for Eskay Creek in September 2022 which highlights an after-tax NPV5% of C$1.4B, 50% IRR, and a 1-year payback at US$1,700/oz Au and US$19/oz Ag. Skeena is currently continuing exploration drilling and plans on releasing a Definitive Feasibility Study for Eskay Creek in Q4 2023.

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Randy Reichert

Executive Chairman President & CEO

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo., Senior Vice President, Exploration & Resource Development, is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this press release constitute “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively, “forward-looking statements”). These statements relate to future events or our future performance. The use of words such as “anticipates”, “believes”, “proposes”, “contemplates”, “generates”, “progressing towards”, “in search of”, “targets”, “is projected”, “plans to”, “is planned”, “considers”, “estimates”, “expects”, “is expected”, “often”, “likely”, “potential” and similar expressions, or statements that certain actions, events or results “may”, “might”, “will”, “could”, or “would” be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the results of the Feasibility Study, processing capacity of the mine, anticipated mine life, probable reserves, the potential impact of the Definitive Feasibility Study for Eskay Creek, and the Maiden Engineering Study for Snip on the anticipated mine life and/or the conversion of resource ounces from the Inferred to Indicated categories or from Measured or Indicated categories to the Reserve category, estimated project capital and operating costs, potential reductions in process plant capital and operating costs, sustaining costs, results of test work and studies, planned environmental assessments, the future price of metals, metal concentrate, and future exploration and development generally and specifically in relation to the potential for additional mineralization in the recently increased land package. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company’s MD&A for the year ended December 31, 2022, its most recently filed interim MD&A, and the Company’s Annual Information Form (“AIF”) dated March 22, 2023. Such forward-looking statements represent the Company’s management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this news release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company’s MD&A for the year ended December 31, 2022, its most recently filed interim MD&A, the AIF dated March 22, 2023, the Company’s short form base shelf prospectus dated January 31, 2023, and in the Company’s other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

Readers should not place undue reliance on such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Cautionary note to U.S. Investors concerning estimates of mineral Reserves and mineral Resources

Skeena’s mineral Reserves and mineral Resources included or incorporated by reference herein have been estimated in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by Canadian securities regulatory authorities, which differ from the requirements of U.S. securities laws. The terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “CIM Definition Standards – For Mineral Resources and Mineral Reserves” adopted by the CIM Council (as amended, the “CIM Definition Standards”). These standards differ significantly from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”). Skeena is not currently subject to the SEC Modernization Rules. Accordingly, Skeena’s disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had Skeena prepared the information under the standards adopted under the SEC Modernization Rules.

In addition, investors are cautioned not to assume that any part or all of Skeena’s mineral Resources constitute or will be converted into Reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any “measured”, “indicated”, or “inferred” mineral Resources that Skeena reports are or will be economically or legally mineable. Further, “inferred mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian securities laws, estimates of “inferred mineral Resources” may not form the basis of feasibility or prefeasibility studies, except in rare cases where permitted under NI 43-101.

For these reasons, the mineral reserve and mineral resource estimates and related information presented herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.